LockBit

LockBit is a notorious ransomware group that operates a ransomware-as-a-service (RaaS) model and is involved in numerous high-profile cyberattacks worldwide. This cybercriminal group supplies its malware to affiliates who execute the attacks, with LockBit developers receiving a share of the ransom payments. A significant crackdown on LockBit, known as "Operation Cronos," was led by global law enforcement agencies, including the NCA and the FBI. This operation aimed to disrupt LockBit's activities by targeting its infrastructure and members. It featured collaboration from multiple international bodies such as Europol, Eurojust, and national agencies across Europe, North America, and Asia

Evolve Bank & Trust

Evolve Bank & Trust, based in Arkansas, USA, provides banking-as-a-service to numerous fintech companies. It offers traditional banking services alongside its partnerships with technology-driven financial companies. This dual role places Evolve at the nexus of modern financial transactions and technology, making it a significant node in the financial industry's network.

The Data Breach Incident

In February 2024, LockBit attacked Evolve Bank & Trust with ransomware. The breach came to light when the group published stolen data on its dark web forum in late June. The data exposed included the names, Social Security numbers, bank account numbers, and contact information of more than 7.6 million individuals. This attack occurred shortly after the Federal Reserve Board mandated improvements to Evolve's risk management and anti-money laundering programs.

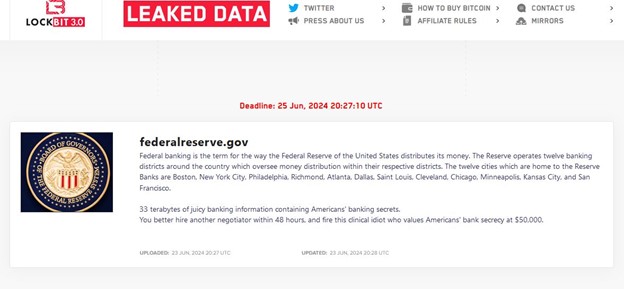

Details of the LockBit Post and Data Leak

LockBit's post on their forum claimed responsibility for the breach and mocked the security measures of the institutions they infiltrated. The leaked data included sensitive personal information, which raised significant concerns about identity theft and fraud among affected customers and partners of Evolve Bank.

Impact of the Breach

The breach severely undermined trust in digital banking, which is crucial to the modern financial ecosystem. The exposed data poses risks of identity theft and fraud, affecting not only Evolve's direct customers but also clients of its fintech partners like Affirm, Mercury, and Wise. These companies had to notify their customers and take additional security measures, highlighting the breach's extensive impact.

Conclusion: Enhancing Security Across Third-Party Partnerships

The Evolve data breach demonstrates the need for rigorous security measures within financial institutions and among their third-party partners. Banks must implement robust cybersecurity protocols and ensure their partners do the same. Effective collaboration and stringent security standards across all parties are essential to safeguard customer data and maintain trust in digital financial services.